₦200 Million in One Weekend: What It Takes to Win Nigeria’s Box Office in 2025

The number is simple and undisputed.

₦200 million in an opening weekend.

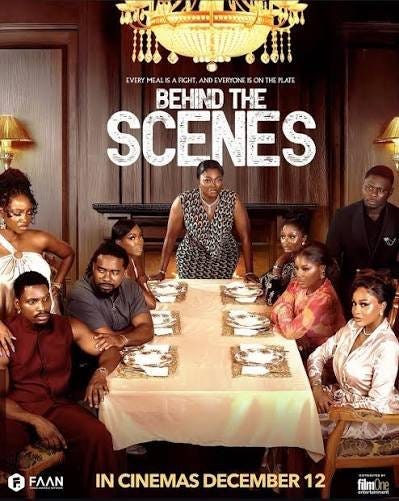

According to FilmOne Box Office data, Behind The Scenes crossed the ₦200 million mark within its first weekend in cinemas, setting multiple opening records and delivering the biggest debut of 2025 so far. No slogans are required to make the point. In today’s Nigerian economy, that figure already speaks loudly.

What matters is not just that the film opened strongly. What matters is why it did, and what that performance reveals about audience behaviour, cinema economics, and market confidence in Nollywood right now.

This is not a story about hype. It is a story about structure.

Why ₦200 Million Matters in 2025

An opening weekend of ₦200 million is not impressive simply because it is large. It is impressive because of the conditions under which it happened.

Nigeria in 2025 is a high-friction consumer market. Inflationary pressure has reduced discretionary spending. Entertainment is competing with essential household costs. Cinema tickets are no longer impulse purchases for many families, especially when transport, food, and time are factored in.

Against this backdrop, a ₦200 million opening signals something specific: a large number of people actively chose to go to the cinema, early, and together.

Opening weekend revenue is the most honest box office metric. It reflects intent, not word-of-mouth momentum. It shows whether audiences believe a film is worth paying for before public consensus forms. In other words, it measures trust.

In 2025, trust is expensive.

Opening Weekends Are About Confidence, Not Curiosity

Total box office runs can be misleading. A long theatrical run can be driven by gradual discovery, discounted ticketing, or limited alternatives. Opening weekend performance is different. It is a compressed test of belief.

For Behind The Scenes to cross ₦200 million in three days means several things happened simultaneously:

Audiences were aware of the film before release.

They believed the film would deliver value.

They were willing to prioritize cinema attendance immediately.

Distribution ensured the film was available at scale, not in pockets.

This combination is rare. Many Nigerian films succeed in one or two of these areas. Few succeed in all four at once.

What Made the Performance Possible

1. Repeatable Star Trust, Not First-Time Excitement

Box office dominance in Nigeria is increasingly tied to consistency, not novelty.

Audiences do not show up in record numbers because a film exists. They show up because past experiences have taught them what to expect. Over time, certain filmmakers and performers convert attention into ticket sales reliably.

This is where Funke Akindele’s position in the market becomes relevant, not as praise, but as precedent. Her films have trained audiences to associate her name with specific outcomes: theatrical scale, communal viewing, accessible storytelling, and cultural familiarity. That expectation reduces risk for the buyer.

In economic terms, she represents a de-risked product.

In a fragile consumer environment, de-risked products win.

2. Female-Led Box Office Power Is No Longer Anomaly

The Nigerian box office has quietly corrected an old assumption. Female-led films are no longer exceptions that succeed despite the system. They are now among the most bankable theatrical products in the market.

What Behind The Scenes reinforces is not just gender representation, but conversion power. The audience that shows up for these films is wide, cross-generational, and loyal. That loyalty has been built over multiple releases, not one viral moment.

This matters for investors and distributors because predictability lowers capital risk. When audiences repeatedly show up for a particular creative leadership, financing becomes less speculative.

3. Distribution Scale Still Decides Outcomes

No opening weekend breaks records without reach.

Nigeria’s cinema market is uneven. Access is concentrated in urban centers, and even then, screen availability is limited. For a film to hit ₦200 million quickly, it must be deployed aggressively and efficiently across major cinema chains.

This means strong distributor relationships, optimal screening schedules, and confidence from exhibitors. Cinemas do not allocate prime slots to films they are unsure about. Early screen dominance is both a cause and effect of anticipated demand.

In this case, distribution was not reactive. It was confident.

4. Marketing Creates Awareness, Not Sales

Marketing alone does not sell tickets. It creates the conditions for trust to activate.

By 2025, Nigerian audiences are extremely marketing-literate. Trailers, billboards, influencer campaigns, and social buzz are expected. What moves them to cinemas is not volume of promotion, but alignment between messaging and prior experience.

The opening weekend success of Behind The Scenes suggests that marketing reinforced belief rather than attempted persuasion. That distinction is important. Persuasion is expensive. Reinforcement is efficient.

What This Says About Cinema Attendance in 2025

There has been quiet skepticism around cinema viability in Nigeria, especially as streaming continues to grow and household budgets tighten. This opening weekend challenges that narrative.

It shows that audience willingness to pay has not disappeared. It has become selective.

Audiences are not rejecting cinemas. They are rejecting uncertainty.

When films meet three conditions, audiences still show up:

Clear value proposition

Trusted creative leadership

Communal relevance

This performance also suggests that theatrical releases still hold cultural weight. Cinema is not just about content consumption. It is about shared experience, especially in a market where entertainment often doubles as social gathering.

Implications for Nollywood as a Business

1. Bankability Is Becoming Clearer

For years, Nollywood struggled with inconsistent performance metrics. This made investment difficult. Strong opening weekend data provides something closer to predictability.

When a film crosses ₦200 million immediately, it sends a signal to financiers: certain projects are no longer speculative art. They are commercial vehicles.

This does not mean every film should follow the same template. It means the industry now has clearer reference points for risk assessment.

2. Cinema Is Still a Viable First Window

Despite the growth of streaming, theatrical release remains a powerful revenue and positioning tool when used correctly. A strong cinema run increases negotiating power for subsequent distribution deals, licensing, and long-term valuation.

Opening weekend dominance strengthens a film’s entire lifecycle.

3. Audience Loyalty Is the Most Valuable Asset

What ultimately drove this performance was not a single campaign or moment. It was accumulated goodwill.

Audience loyalty is slow to build and fast to lose. In 2025, it has become the most valuable currency in Nigerian entertainment. Films that treat audiences as long-term stakeholders rather than one-time buyers will continue to outperform.

What Investors Should Pay Attention To

This opening weekend is not just a creative success. It is a market signal.

It indicates that:

Nigerian cinemas can still generate high early revenue.

Audiences respond to consistency more than experimentation.

Star power, when combined with proven delivery, reduces downside risk.

Female-led projects are commercially dependable, not niche.

For investors evaluating Nollywood in 2026, these are not soft insights. They are actionable indicators.

What This Signals for 2026

The success of Behind The Scenes suggests that the Nigerian film market is entering a more disciplined phase.

In 2026, we are likely to see:

Greater emphasis on opening weekend strategy

More data-driven release planning

Increased investor interest in proven creative leaders

Higher expectations for marketing-to-delivery alignment

Fewer bets on untested scale without audience trust

This does not mean creativity will shrink. It means creativity will be paired more closely with commercial intelligence.

Final Thought

₦200 million in one weekend is not a miracle. It is a result.

It reflects years of audience relationship-building, disciplined distribution, and clear market positioning. In 2025, winning Nigeria’s box office is no longer about noise. It is about reliability.

The lesson for the industry is straightforward.

Attention is easy to generate.

Trust is not.

And in today’s cinema economy, trust is what sells tickets.

A guest post by

A curious mind exploring the crossroads of creativity and insight.

The emphasis on opening weekend as a trust indicator rather than just a revenue metric is really smart. In markets where disposable income is under pressure, peopledo bet on known quantities, and Funke Akindele basically built a reliability brand over years. The piece about de-risked products winning in fragile consumer environments applies beyond film too. I saw something similar with a food delivery startup in Lagos where the ones with consistent quality beat the cheaper ones once wallets got tighter. Cinema over comprehension might look cool but it delays the hard work of actually solving distribution and adoption problems at scale.