Seven Things Africa’s Creative Industry Learned in 2025

2025 did not just deliver another wave for Africa’s creative economy. It marked a turning point where growth, digital adoption, global appeal, and structural cracks all became visible at the same time. As the year ends, these seven lessons stand out, not as theories, but as signs of how the creative sector has shifted across the continent.

1. Streaming and Mobile Connectivity Are Reshaping the Creative Ecosystem

Internet access across Africa surged again in 2025. According to a recent industry summary, about 416 million people across Africa now use mobile internet, roughly 28 percent of the population.

Mobile technologies are not just connecting people. They are actively supporting the continent’s creative infrastructure. In 2024 alone, mobile tech contributed about $220 billion to Africa’s GDP, roughly 7.7 percent of the continent’s economic output.

For creators, this matters. It means there are now hundreds of millions of people with access to the internet and a mobile device, the basic tools for content consumption and creation.

At the same time, streaming platforms and digital consumption are replacing legacy media. In Nigeria, official reports show that digital channels made up 62 percent of total entertainment revenue in 2023, a steep rise from 28 percent in 2019.

Meanwhile, traditional cinema and scheduled television continue to lose ground. Urban TV viewership fell 43 percent between 2019 and 2024 in parts of Nigeria, replaced by on-demand streaming.

The lesson is clear. Streaming and mobile internet now form the structural base for Africa’s creative economy.

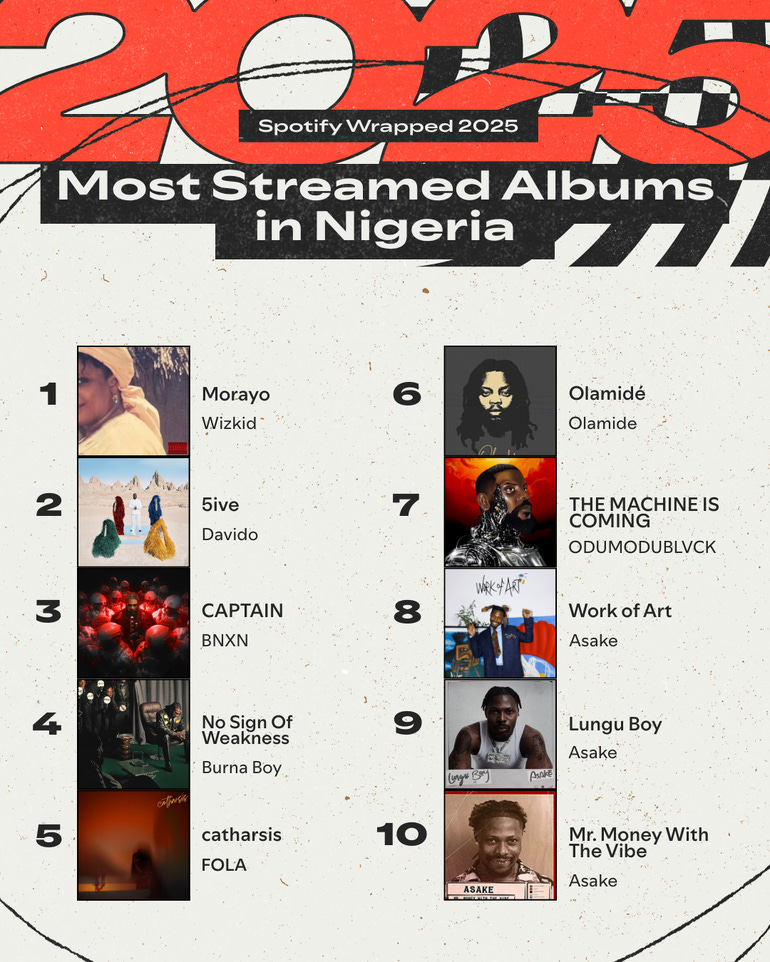

2. 2025 Confirmed: Afrobeats and African Music Are Still Global Currency

Spotify Wrapped 2025 offered clear proof that African music exports are not a trend, they are a foundation. Public reporting shows listenership of Afrobeats globally grew by 22 percent in 2025.

In Nigeria, Africa’s largest music market, local music consumption shot up 82 percent over the previous year. Daily streams rose by 23 percent. Podcast consumption also jumped 97 percent, while local podcast creation increased by 48 percent.

0Beyond numbers, the cultural significance is unmistakable. Nigerian artists dominated local charts while Afrobeats and related genres held ground globally. For the continent’s creative economy, 2025 offered proof that music remains one of its strongest export engines.

This matters because it emphasizes that Africa’s cultural output is not peripheral. It is globally competitive.

3. The Creator Economy Is Growing but Still Fragile Without Structural Support

Despite the boom, 2025 highlighted a painful paradox. The creative economy is growing fast, but support structures remain weak. In Nigeria, the first comprehensive Creator Economy Report pegged the sector’s value at $31.2 million in 2025.

That value is low compared with global creative economies, and therein lies the issue. Africa is creating content at global scale, but translating cultural influence into sustainable economic value remains a struggle. A longtime critique resurfaced this year. The creative industry is underfunded. Government support remains minimal. As one 2025 analysis put it, despite billions in cultural exports and hundreds of millions generated through music, streaming, and film, investment in infrastructure and regulation remains limited.

Yet the demand signals are strong. With growing mobile internet, rising streaming consumption, and a youthful population eager for local content, the gap is more about structure than potential.

2025 taught the industry that talent and traction are not enough. The next wave depends on stable systems, policy support, and monetization frameworks.

4. Small Creators and Niche Voices Earn Real Spotlight and Value

One of the most encouraging signs of 2025 was how performance metrics began favoring smaller creators and niche voices. Micro and nano-creators, those without massive follower counts, began delivering impressive engagement, authenticity, and niche reach to brands.

Large corporations such as telecoms, beverage companies, and lifestyle brands responded. Their 2025 campaigns deployed fleets of smaller creators instead of a handful of celebrities. This allowed for more nuanced, localized storytelling and deeper community connection. These creator-first campaigns recognized that reach is not just about numbers, but about resonance and authenticity. Several marketing reports from the year highlight this shift.

This pattern changed who gets tapped, who gets paid, and who shapes narratives. For Africa’s creative economy, it means more diverse representation, more grassroots voices, and real opportunity for creators outside capital cities and mainstream circles.

2025 proved creativity no longer flows top to bottom. It spreads laterally.

5. Africa’s Creative Hubs Are Multiplying and Geography Is No Longer a Limit

For decades, major creativity has concentrated in a few hubs: Lagos, Johannesburg, Nairobi. In 2025, that map expanded.

New creative corridors emerged across Ghana, Kenya, East Africa, and Nigeria’s secondary cities. Ghana’s fashion and content creators gained global recognition. Kenya’s animation, gaming, and youth-driven digital scenes showed growing maturity. These hubs began attracting international collaborations, regional talent exchanges, and even startup interest.

What this expansion offers is survival through redundancy. It reduces the pressure on singular cities. It spreads talent across multiple markets. It builds a more resilient creative economy capable of riding out shifts or shocks.

2025 showed that Africa’s creative heartbeat no longer relies on one city, one language, or one market. It is becoming continental.

6. Tech Tools and AI Are Democratizing Production but Amplifying Pressure

Technology in 2025 made content creation more accessible than ever. With affordable smartphones, rising internet access, mobile subscriptions, and a thriving telecoms ecosystem, many Africans now have the tools to create, stream, share, and build. According to GSMA, Africa’s mobile sector, which contributed $220 billion to GDP in 2024, continues to expand its footprint and infrastructure.

Video-first consumption, mobile editing apps, low-cost data packages, and short-form content preferences have turned creation into something almost anyone can try.

But this democratization came with expectations and pressure. As more people created, competition intensified. The need for consistent output, high engagement, fast turnaround, and frequent reinvention increased. Creators found themselves racing trends rather than storytelling.

For Africa, 2025 highlighted a new reality. With greater access comes higher creative demand. The tools are now widely available, but sustainability depends on strategy, vision, and resources, not just talent.

7. Domestic Economics Are the Largest Barrier to a Sustainable Creative Industry

Perhaps the most difficult lesson of 2025 had nothing to do with talent, platforms, or technology. It had to do with economics and real purchasing power.

Even as streaming, mobile internet, and creative output rose dramatically, a large share of the population remains unable to support a full-time creator economy through consumption alone. For many African households, paying for subscriptions, buying merchandise, purchasing digital products, or supporting Patreon-style models remains a luxury.

That reality was clearer than ever in 2025. The industry’s growth metrics highlight a painful paradox. Demand is real. Consumption nearly is not.

This disconnect raises serious structural questions. How many local creators can survive on streaming payouts? How many video-first or long-form storytellers can rely on ads or subscriptions? How many more need brand deals to survive? As one 2025 analysis concluded, Africa does not lack creative talent. It lacks consumer capacity.

If the creative economy is to scale beyond hit-and-hope models, then 2026 must be about building stronger economic foundations. Diversified monetization, policy support, infrastructure, and audience investment will be key.

What 2026 Should Be Built On: A Roadmap for Real Growth

Strengthen payment infrastructure. Platforms must support reliable, transparent payment systems, especially for local markets.

Support micro and regional creators. Not all value is in virality. Small-scale, niche, regional voices are essential to cultural diversity and resilience.

Invest in creative infrastructure. Film distribution networks, local streaming platforms, community hubs, legal frameworks, and licensing bodies matter more than ever.

Encourage use of tech tools including AI, mobile editing, and low-cost production, but also build training around creative ethics, storytelling quality, and sustainability.

Promote domestic consumption. Affordable subscriptions, tiered pricing, ad-supported models, and localized content will strengthen the foundation. Creators should not only rely on global audiences or diaspora markets.

Broaden creative hubs. Encourage growth in smaller cities, invest in regional talent, and support cross-country collaborations.

Conclusion: 2025 Did Not Promise the Future, It Showed It

2025 did not just deliver headline-grabbing hits, viral songs, or flashy moments for Africa’s creative industry. It delivered clarity. It exposed what works, what fails, where the opportunities lie, and where the crack points are.

African creativity is not fragile. It is abundant. What remains fragile are the systems and structures meant to support it.

If 2026 wants to be more than a repeat of 2025’s highs, the industry — creators, platforms, governments, investors — needs to build. Build payment infrastructure. Build creative hubs. Build rights frameworks. Build from grassroots. Build for sustainability.

The continent is ready. The tools are available. The audience is here. What remains is will and structure.

When Africa matches its creative ambition with economic and structural backbone, 2026 will not just be another year of hits. It will be the year the creative economy becomes real.

A guest post by

A curious mind exploring the crossroads of creativity and insight.