Driving Africa’s Creative Economy: Meet the 15 FX Award-Winning African Banks of 2025

Africa’s creative economy thrives on innovation, collaboration, and the seamless flow of ideas and capital across borders. Behind the scenes of this dynamic sector, financial institutions play a pivotal role in enabling trade, supporting entrepreneurs, and powering the continent’s creative industries. Global Finance’s GW Platt Foreign Exchange Bank Awards 2025 has spotlighted 15 African banks for their exceptional performance in the foreign exchange (FX) market—a crucial backbone of Africa’s economic and creative growth.

The Intersection of FX Banking and Creativity

For Africa’s creative economy, FX services are more than just currency exchange. They are enablers of regional collaboration, digital entrepreneurship, and global market access. As African creatives—from fashion designers in Lagos to filmmakers in Nairobi—expand their reach, the ability to navigate FX markets efficiently becomes critical. These 15 banks have demonstrated excellence in facilitating cross-border payments, trade financing, and investment opportunities, directly impacting the creative sector’s growth.

Celebrating Africa’s Top FX Banks

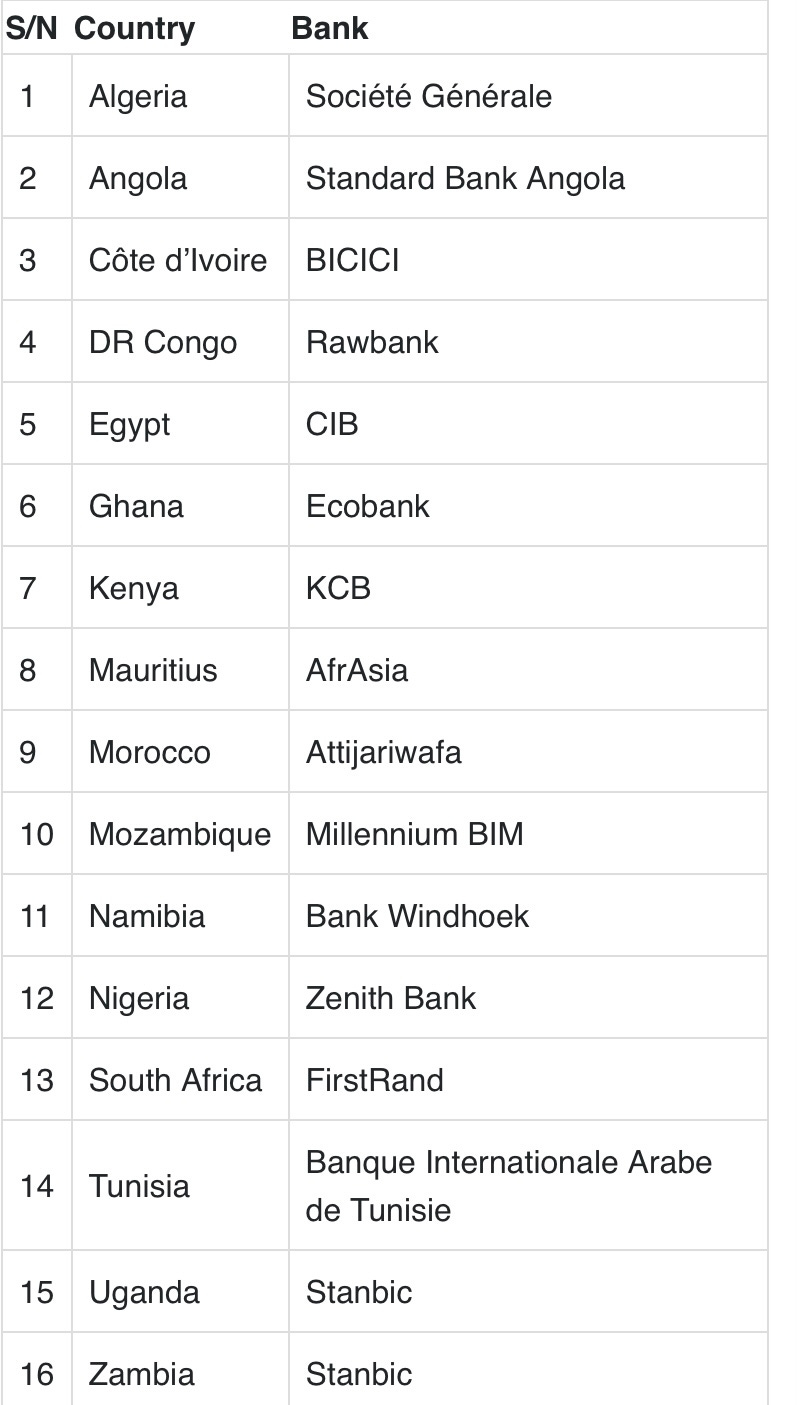

This year, Standard Bank was crowned the regional winner for Africa, standing out as a leader in FX innovation and client services. From Egypt to Zambia, here are the 15 banks that have set the benchmark for FX excellence in 2025:

These institutions have been recognized for their innovative approaches, robust technology adoption, and resilience in addressing Africa’s unique challenges.

Key Trends Powering FX in Africa

The recognition of these banks comes at a time of remarkable transformation in the FX market:

Record FX Trading Volumes: According to J.P. Morgan, daily FX trading volumes hit $7.5 trillion in 2025, reflecting growing demand for foreign exchange services worldwide.

Post-Pandemic Growth: The pandemic accelerated the need for efficient cross-border financial systems, with FX transactions surging as businesses adapted to a digital-first economy.

Innovation at the Sales Desk: Digital tools and artificial intelligence are revolutionizing how banks manage FX trading, enabling personalized solutions for clients across industries.

FX Banking: A Lifeline for Africa’s Creative Industries

For Africa’s creative economy, FX challenges are part of the landscape. Many creatives rely on cross-border payments to collaborate with international clients, purchase materials, or fund projects. Yet, challenges such as economic volatility, fluctuating commodity prices, and low financial inclusion persist. The award-winning banks have risen to the occasion, providing tailored solutions to navigate these hurdles:

Innovative Payment Solutions: Platforms like Ecobank’s Rapidtransfer have simplified remittances and cross-border payments, especially for freelancers and small businesses.

Trade Financing: Institutions like FirstRand and Zenith Bank support import-export transactions crucial for industries like film equipment, textile imports, and tech gadgets.

Creative Sector Support: Banks such as Stanbic have specifically championed initiatives for creatives, including funding schemes for filmmakers and cultural entrepreneurs.

Why This Matters for Africa’s Creative Economy

The recognition of Africa’s FX leaders is a testament to the continent’s growing integration into global markets. As the creative economy expands, financial institutions must evolve to meet the demands of a vibrant and globalized creative workforce. These banks are not just facilitating transactions; they are empowering the dreams of African creatives who are reshaping narratives and driving cultural and economic transformation.

Looking Ahead

As the global FX market is projected to grow at a compounded annual rate of 7.14% through 2032 (Market Data Forecast), African banks are poised to play an even more significant role. The GW Platt Foreign Exchange Bank Awards 2025 serves as both recognition and motivation for the financial sector to continue innovating and supporting the creative economy.