Africa’s Hotel Sector: AI Hospitality?

Africa’s hospitality industry is on the verge of monumental growth, with projections indicating a market value of $731.4 billion by 2032. This surge is driven by a mix of factors, including a youthful and expanding population, an increase in foreign direct investment (FDI), and the strategic entry of international hotel chains. As the continent becomes a focal point for global investors, the hotel infrastructure is rapidly evolving, with over 92,000 new rooms currently under construction. These developments are not only reshaping the physical landscape of Africa’s hospitality sector but are also integrating cutting-edge technologies to meet the demands of a modern, tech-savvy clientele.

Growth Drivers in Africa’s Hospitality Sector

1. Demographic Advantage

One of the most significant factors driving growth in Africa’s hospitality sector is its young and expanding population. Africa boasts one of the youngest populations globally, with the median age being around 19.7 years. This youthful demographic is increasingly mobile, urbanized, and more likely to explore regional and international travel, especially as disposable incomes rise in key African markets.

Additionally, as urban centers in Africa expand, cities like Lagos, Nairobi, Cairo, and Johannesburg are emerging as major hubs for business and leisure tourism. This urban growth fosters greater demand for hotel accommodations, conferences, and business events. With more Africans engaging in travel for both business and leisure, the hospitality industry is witnessing increased domestic demand, which complements international arrivals.

2. Foreign Direct Investment and the Entry of Global Hotel Chains

The influx of foreign direct investment (FDI) is another significant driver behind the growth of Africa's hospitality industry. International hotel chains such as Marriott International, Hilton, Accor, Radisson Hotel Group, and IHG have been instrumental in boosting Africa’s hotel capacity. These global giants are investing heavily in the continent, recognizing its potential as a major tourism and business destination.

For instance, Marriott International, the world’s largest hotel chain, leads Africa’s hotel development pipeline, with 138 hotels (15,011 rooms) currently under construction. Hilton, Radisson, Accor, and IHG follow closely, together accounting for 71% of the hotel rooms in development across the continent. The expansion of these chains not only increases the availability of world-class accommodations but also brings global standards of service, sustainability, and technology to African cities and resort destinations.

3. Technological Integration and AI’s Role in Hospitality

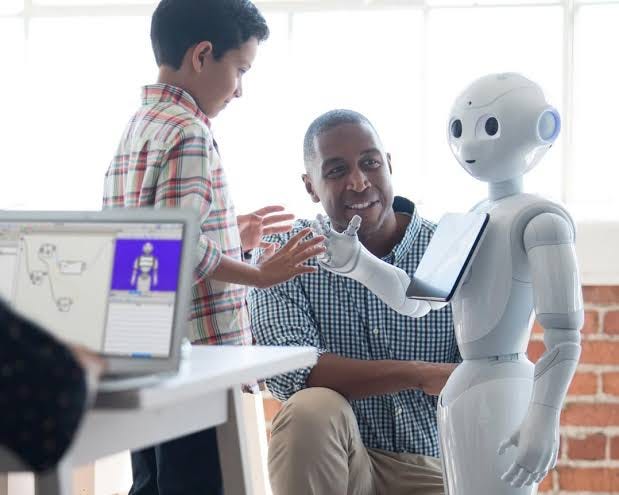

In recent years, the adoption of advanced technology, particularly artificial intelligence (AI), has become a game-changer for Africa’s hospitality sector. AI is now a critical differentiator, driving efficiency, improving guest experiences, and enabling more personalized services. Global hotel chains are increasingly deploying AI-driven solutions to enhance operations, streamline customer interactions, and offer tailor-made guest experiences.

Accor, Hilton, and Radisson Hotel Group, for example, have incorporated AI into various aspects of their operations, from chatbots that handle customer queries to AI-powered room service systems that anticipate guests' needs. AI is also being used to analyze customer data, offering insights that help hotels personalize experiences for their guests. For instance, AI can recommend personalized room settings, dining options, or even local experiences based on a guest’s past preferences.

However, while AI can enhance operational efficiency, it is crucial to maintain the human element in hospitality. According to HotelTechReport’s State of Hotel Guest Technology Report 2024, 70% of surveyed hotel guests still prefer the human touch for complex queries, although 65% appreciate advanced technology in their hotel experiences. This balance between AI-driven convenience and human interaction is likely to define the future of hospitality in Africa, with technology serving as a tool to enrich rather than replace the personal touch that guests value.

Africa’s Hotel Development Pipeline

The African hospitality sector’s growth is reflected in the substantial hotel development pipeline documented in the 2024 African Hotel Chain Development Pipeline Report. The report, based on research conducted by Lagos-based W Hospitality Group, highlights the rapid expansion of hotel infrastructure across the continent. With over 92,000 rooms in 524 hotels under development in 41 of Africa’s 54 countries, the continent is undergoing a hotel boom that rivals other global regions.

1. Geographical Distribution of Hotel Development

Egypt dominates Africa’s hotel development landscape, with nearly 26,250 rooms in 109 hotels under development. This is larger than the combined number of rooms in the next four countries—Nigeria (7,622 rooms), Morocco (7,169 rooms), Ethiopia (5,128 rooms), and South Africa. Egypt’s strong pipeline reflects the country’s growing importance as a global tourism hub, attracting significant investment from both regional and international hotel operators.

Nigeria, the most populous country in Africa, holds the second-largest hotel pipeline with 50 hotels under development. Lagos, the commercial hub of Nigeria, continues to attract hotel investments due to its status as a regional business center. With increasing demand for both business and leisure travel, Nigeria remains a key market for hotel development.

Morocco and Ethiopia follow, with notable pipelines in cities like Marrakech and Addis Ababa, respectively. The steady rise of hotel projects in these countries reflects their appeal as both cultural destinations and business travel hubs. Ethiopia, in particular, has seen a surge in hotel development as Addis Ababa continues to grow as a key diplomatic center due to the presence of organizations like the African Union.

2. Resort Developments on the Rise

A notable trend in the African hospitality sector is the rapid growth of resort developments. Resorts now account for 30% of the total hotel pipeline, up from 24% in 2023. The Indian Ocean islands, particularly Zanzibar and Cape Verde’s Boa Vista, have seen substantial investment in resort infrastructure. For instance, the pipeline in Zanzibar has grown from seven resorts with 983 rooms in 2023 to 14 resorts with 2,048 rooms in 2024.

This focus on resort development underscores Africa’s potential as a global leisure destination. The continent’s stunning landscapes, from the beaches of Zanzibar to the wildlife reserves in Kenya and South Africa, are drawing tourists from around the world. Investors are capitalizing on this by building luxury resorts that cater to high-end international travelers.

3. Hotel Openings and Actualization in 2023

Despite the challenges posed by global economic uncertainties, 2023 saw the opening of 29 chain hotels and resorts in Africa. Of these, 10 were in North Africa and 19 in sub-Saharan Africa. Tanzania led the way in sub-Saharan Africa, with six new hotels and resorts opening, reflecting the growing popularity of both the mainland and Zanzibar among international investors and tourists.

While 2023 was a slow year for hotel actualization, the outlook for 2024 is more optimistic. The top 10 hotel chains expect to open 139 hotels with 19,122 rooms across the continent. This anticipated surge in openings is a testament to the confidence investors have in Africa’s hospitality sector, particularly as tourism rebounds following the disruptions caused by the COVID-19 pandemic.

The Role of AI and Automation in the Future of African Hospitality

As Africa’s hospitality sector continues to grow, the role of AI and automation in hotel operations will only become more pronounced. AI has already made significant inroads in guest services, such as automating room service, providing personalized recommendations, and even enhancing the check-in process through facial recognition technology.

For instance, Radisson Hotel Group has introduced AI-powered meeting experiences through its Meetings Unboundinitiative. This allows for more creative and visually engaging meetings, combining AI with human-led hospitality to create memorable guest experiences. Such innovations are setting new benchmarks for the industry, ensuring that African hotels can offer world-class services to both leisure and business travelers.

Additionally, robotic process automation (RPA) is being used to streamline back-office operations, reducing administrative tasks and allowing staff to focus on delivering exceptional guest experiences. Hotels that successfully integrate AI and automation will likely lead the pack in operational efficiency, providing a competitive edge in an increasingly crowded market.

Challenges and Opportunities

While the growth of Africa’s hospitality sector is impressive, it is not without its challenges. The lengthy timeframes between hotel deals being signed and actual openings—sometimes as long as 10 to 16 years—underscore the complexities involved in bringing new projects to fruition. Issues such as bureaucratic delays, infrastructure gaps, and financing challenges can slow down the development process.

However, these challenges also present opportunities for innovation. Governments and private investors can collaborate to streamline approval processes, improve infrastructure, and develop financing solutions tailored to the needs of the hospitality industry. Furthermore, as African economies diversify and tourism continues to rebound, there is potential for even more rapid growth in the coming years.

Conclusion: Africa’s Hospitality Sector at a Crossroads

Africa’s hospitality industry is at a critical juncture. The combination of a youthful population, increasing FDI, and technological advancements positions the continent as one of the most exciting hospitality markets in the world. The rise of AI and automation is reshaping guest experiences, making hotels more efficient and personalized, while resort developments are turning Africa into a premier global leisure destination.

The road ahead will not be without challenges, but with strong investment, continued innovation, and a focus on sustainability, Africa’s hospitality sector is poised for robust growth. As the industry moves forward, it will play an essential role in shaping the continent’s future, driving economic development, and creating jobs. The next decade promises to be a transformative period for African hospitality, as it reaches new heights and establishes itself as a key player on the global stage.